Redefining Motor Insurance Stickers in the Era of MID

By Bernard AKYIN-ARKOH

Over the past few years, technological advancements have reshaped numerous industries, with the insurance sector being no different.

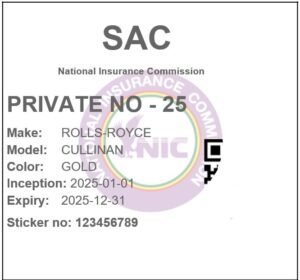

One significant advancement in Ghana’s motor insurance industry is the launch of the Motor Insurance Database (MID). This online system aims to streamline and improve the process of verifying vehicle insurance coverage.

This technological development has led to increased questioning about the relevance and importance of the conventional motor insurance decal placed on car windshields.

Mandatory vehicle insurance in Ghana

In certain nations like Ghana, having motor insurance is mandated by law. The Motor Vehicles (Third Party Insurance) Act from 1958 ensures that motor third-party insurance is obligatory in Ghana, as stated in Section 3(1) of the act, which states: “Notwithstanding anything contained herein, no individual shall operate, nor allow another person to drive, a motor vehicle without ensuring an active policy of insurance or equivalent security covering third-party liabilities according to the stipulations outlined within this legislation.”

The Vehicle Insurance Registry in Ghana

The Motor Insurance Database (MID), implemented starting January 1, 2020, represents a crucial advancement in updating Ghana’s insurance sector. This system was established to address the issue of vehicles using counterfeit motor insurance decals, thus safeguarding individuals and assets.

This unified digital platform gathers up-to-date information about insured cars, enabling officials and involved parties to quickly verify a vehicle’s insurance standing without depending on paper records.

By just calling *920*57# and adhering to the instructions to input a car’s license plate number, individuals can quickly obtain insurance information including the automobile brand, paint color, the company providing coverage, the policy initiation date, and when it expires.

A major advantage of the MID lies in enhancing the efficiency and precision of insurance validation. By having current information readily available, enforcement officials can reduce fraud and confirm that every vehicle on the roads carries proper coverage. This shift towards digital verification aligns with worldwide advancements in insurtech.

Nonetheless, the human element continues to be a crucial aspect. In regions where digital infrastructure or internet connections are lacking, people might not have instant access to electronic verification systems. In these situations, a tangible insurance decal on the car window can still function effectively as a practical confirmation of insurance coverage.

Even with the evident benefits of the MID, obstacles persist. Problems such as technical glitches or service interruptions could impede immediate digital validation at times. Moreover, various parties might still favor or demand a concrete, physical proof of insurance coverage, keeping the importance of motor insurance decals intact in particular scenarios.

The change from using physical motor insurance decals

As the implementation of the Motor Insurance Database progressed, the traditional use of placing motor insurance decals on car windshields has steadily decreased. Nowadays, digital checks offer immediate validation of insurance coverage, diminishing the necessity for tangible stickers to verify one’s insurance status.

This change brings up an essential query: Does the law require you to show a motor insurance decal on your windshield?

Notably, the necessity to exhibit a motor insurance sticker is not explicitly outlined in the Insurance Act, 2021 (Act 1061). Rather, this obligation stems from an amalgamation of legal statutes and regulatory instructions within Ghana’s insurance and traffic legislations.

According to Section 3(1) of the Motor Vehicles (Third Party Insurance) Act, 1958 (No. 42), it states: “Notwithstanding the provisions of this Act, no individual shall operate, nor allow another person to operate, a motor vehicle without having an active insurance policy or adequate security covering third-party risks that aligns with the requirements set forth in this legislation.” This mandates the necessity for individuals to maintain proper auto insurance coverage legally.

According to Section 17(1) of the aforementioned Act, “Anyone operating a motor vehicle on a public road must, when asked by a law enforcement officer, provide their name and address as well as the name and address of the vehicle’s owner, along with presenting their insurance certificate. Failure to comply with these requirements constitutes an offense under this legislation.” This requirement ensures that drivers have their insurance documentation readily accessible for review when requested.

Although the Insurance Act, 2021 (Act 1061) doesn’t specifically mandate the display of insurance decals on car windshields, it gives the National Insurance Commission (NIC) the power to manage and supervise the insurance sector. According to Section 203, the NIC has the authority to create essential forms, certifications, and paperwork required for adherence.

Consequently, the requirement to show the insurance sticker on the windshield originates from regulations set forth by the National Insurance Commission (NIC), which are implemented in practice through oversight provided by the Motor Traffic and Transport Department (MTTD) of the Ghana Police Service.

Regarding the roadworthiness certification, the Road Traffic Act of 2004 (Act 683) clearly mandates that a valid roadworthy sticker must be shown. As stated in Section 95 of this act:

Section 95 – Issuance of Road Usage Permit/Sticker

- Upon paying the required fee, the Licensing Authority will provide the applicant with a certification in the form of a sticker for their automobile.

- The sticker shall be carried on the front windscreen of the motor vehicle so as to be readily identified by a police officer or the Licensing Authority.

- The validity period for a road use certificate will be six months for commercial vehicles and twelve months for private automobiles from the issuance date before expiring.

- If the Licensing Authority determines that a road use certificate has been damaged beyond recognition or is missing, they have the authority to issue a new copy of the certificate after the required fee is paid.

This clause explicitly mandates the obligation to showcase the roadworthy sticker on the windshield, as opposed to the less direct or advisory stipulation regarding insurance decals.

Conclusion

In Ghana’s developing insurance landscape, influenced by the Motor Insurance Database, the requirement for motorists to display an insurance sticker on their vehicle windshields necessitates careful thought.

Although digital verification provides greater efficiency and trustworthiness, the ongoing employment of physical stickers tackles practical issues like system failures and limited access, particularly within more disconnected areas.

Balancing technological advancements with traditional methods will be crucial for establishing efficient and equitable insurance verification within Ghana’s motor insurance sector.

>>>the writer

Is a Fellow of the Chartered Insurance Institute UK (ACII-UK), Certified Chartered Property Casualty Underwriter (CPCU), and has earned an Associateship in Risk Management (ARM). With a reputation as a skilled writer, he was recognized as the second-runner up in the 2024 AIO-YIPs African Next Generation Award and also garnered the Young Achiever Award at the 2024 Ghana Insurance Awards. Holding an Executive MBA in Finance from the University of Ghana’s Legon campus, he serves as a manager at Star Assurance Limited. Beyond his managerial duties, Bernard contributes expertise to the Ghana Insurance College (GIC) and participates actively in the Professional Education and Research Committee within the Chartered Insurance Institute of Ghana (CIIG).

He can be contacted through

+233249236939

and or

akyinarkohbernard@gmail.com

References

- Insurance Act, 2021 (Act 1061)

- The Motor Vehicles (Third Party Insurance) Act, 1958 (No. 42)

- Road Traffic Act 2004 (Act 683)

- Akyin-Arkoh, B. (2024). The insurance sector of Ghana: An extensive overview of general insurance.

-

Provided by SyndiGate Media Inc.

Syndigate.info

).

Share this content:

Post Comment